How to Send Your Kid to College in Oregon: Funding Costs and Strategies

Ask an average parent how much it will cost their kid to go to college in 5, 10, or 15 years and you will get a blank stare. Then ask them how they plan on paying for college and you will see terror in their eyes.

Most of the terror has come from the rising cost of college that we’ve seen in the last twenty years. From 2000-2021, average tuition and fees rose by 65%, from $8,661 to $14,307 a year.[1]

And these figures are for tuition only, which doesn’t include cost of room and board, books and other expenses.

In order to afford the rising cost of college, many students and parents have taken out student loans to bridge the gap between their savings and the cost to attend.

Here are a few statistics on students loans from NerdWallet:

As of 2024, Roughly 43 million Americans have outstanding federal student loan debt — that's about 13% of the U.S. population, per census data.

The federal government owns 1.6T of the total $1.7T of outstanding student loan debt.

The average undergraduate student graduates with roughly $29,000 of student loan debt.

The current student loan interest rate for Federal Direct Unsubsidized loans is 5.5% for undergraduates and 7% for graduate students.

Today’s high cost of college reality is already pretty grim, so it’s really hard to imagine what the situation will be like in 10 years or more.

But, in order to start somewhere, most financial planning softwares or college cost calculators use an average increase of 5% per year vs. a long-term inflation rate of 2.5%.

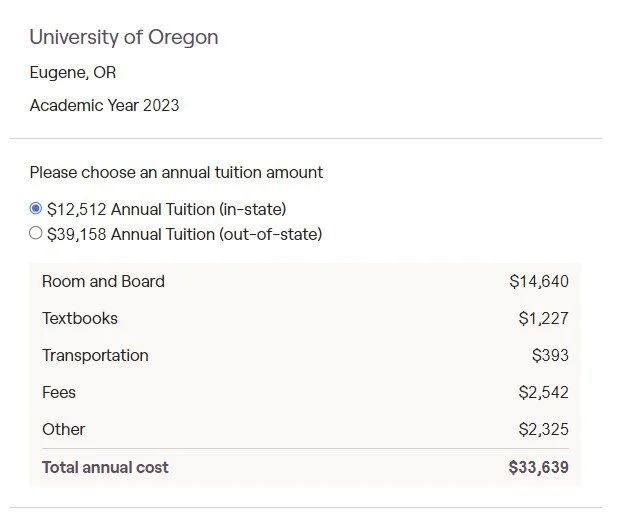

So how much does a public state school undergraduate education cost today? Here is the breakdown for the University of Oregon (courtesy of RightCapital):

The University of Oregon has a program that locks in your tuition rate for all four years, so if your student can finish the degree in four years, the total cost of tuition & fees is $50,048 or $134,556 all-in which includes room & board.

Here’s what the costs will grow to be (in today’s dollars) over the next 15 years assuming 5% educational inflation and 2.5% general inflation:

I’ve highlighted 2030 and 2032 because those are the years my two children, now age 10 and 12, will be starting college. Yikes!

I know what you’re thinking: how on earth are we going to pay for that? Don’t lose hope just yet…

Here are a few ideas and suggestions to help you craft your personal college funding strategy. Note that every family will most likely use a combination of the following sources of funds:

1. Save & Invest Before College: The 529 College Savings Account

The State of Oregon offers a 529 college savings account that will give you tax credits for contributing a certain % of your income each year.

Each fund is set up for a specific beneficiary (child), and there are helpful tools to help you set up an automatic savings deposit every paycheck and options to allow friends and family to gift funds into the account.

While it is typical for the parent of the student to own the account, many grandparents choose to open and contribute to 529 accounts as well. One nice thing about this strategy is that the FAFSA (Federal Application for Financial Student Aid) no longer uses funds available in a grandparent’s 529 account to calculate how much a family can contribute to the cost of college.

Parents, grandparents and others can each contribute up to $18,000 a year, gift-tax free, to a 529 account. There is also an option to fund 5 years of maximum contributions but a special tax form needs to be completed.

Want to Learn More about the Oregon College Savings Plan? Click here to read my blog post: How to Start Saving for College in Oregon

2. Financial Aid: Grants, Scholarships, Awards & Work-Study Programs

Every family, regardless of wealth, should fill out the FAFSA every year. This form determines your family’s “Student Aid Index” (which recently replaced the “Expected Family Contribution”).

The SAI is what determines whether your child will receive any financial aid. If the cost of college is more than your SAI, then your child may be eligible for aid such as Pell Grants, work-study and other state-based grants.

The SAI uses four main inputs: parent’s income, parent’s assets, child’s income and child’s asset (where the income and assets of the child impact the SAI more than the parents). Income is determined by values from two years ago.

Some assets that are not included as assets for parents include your primary home, retirement accounts and value of a small business or family farm. Assets that are included are checking, savings, investments like a brokerage account, an investment property or a vacation home.

3. Pay On Demand: i.e. Make tuition payments from your annual income during years your child is in school

With enough visibility and planning, there are ways to free up room in your budget to pay a portion of the cost of college from your ongoing paycheck.

For example, perhaps you pay off your auto loan before your child goes to college. With the average car payment today between $600 and $800, this could free up roughly $8,000 over the year to pay towards your child’s schooling.

Another option is to accelerate your mortgage pay-down by making extra principal payments. Depending on the age of your child, you may be able to either pay-off your mortgage before they start college OR pay down the principal enough to refinance into a new 30-year term and drastically lower your monthly payment. (This strategy is dependent on the mortgage rates available at the time, which carries some risk).

Take a look at your budget and ask yourself what you are willing to give up to help pay for your child’s education.

Time to pay off that souped-up Subaru lease or loan. Little Timmy needs a college degree.

4. Take advantage of (the right kind of) Student Loans

The federal government, in their effort to address the mounting student loan crisis, passed new laws over the last few years to make it easier to repay student loans and even get the loans forgiven.

The SAVE program (Saving on a Valuable Education) is an income-driven repayment plan that goes into full effect in July 2024.

The benefits vs. current repayment plans are threefold: 1) it reduces the minimum monthly payment, 2) it subsidizes the government interest charges that aren’t fully paid by monthly payments from the borrower, and 3) it shortens the timeline to debt forgiveness.

What the SAVE plan effectively does is guarantee an affordable student loan payment while ensuring you don’t go into MORE debt from interest accrual after you begin repaying the loan. And if you still owe a balance after twenty or twenty-five years of repayments, then the Federal government will forgive the loan balance.

The SAVE plan is only available for Federal Direct Loans, and, like any law made by the government, has lots of nuances to which loans qualify, so be sure to read up on the details.

One other program to note when thinking about borrowing money from the Federal government is the Public Service Loan Forgiveness. If your child plans to work in a field where they can go to work for the government or a non-profit for 10 years, then their student loans could be eligible for forgiveness.

5. Gifts from Relatives

If a grandparent or other generous relative is interested in helping to cover the cost of an education for your child, there are additional options outside of contributing to a 529 account.

Direct tuition payments from the relative to the educational institution are not subject to the annual gift-tax exclusion amounts. Relatives can make payments from retirement accounts or taxable accounts directly to the school.

6. Creatively Lower the Cost of a 4-Year Degree

Consider two years of community college before transferring to a four-year institution

Not only is the price of tuition for community college (in this case, Lane Community College) about half the cost of University of Oregon, but the State of Oregon is now offering the Oregon Promise Grant which covers a large majority of the cost of tuition for recent high school graduates. There can be more than a 6 month gap between finishing high school and starting Fall term at an Oregon Community college. There may be income phase-outs for the grant in the future, but there is not one currently. Learn more here: https://oregonstudentaid.gov/grants/oregon-promise-grant/

Once the student transfers to the U of O and completes the degree requirements there, they will graduate with the same diploma as a student who attended the U of O for all four years.

Saving on Room & Board: Have your student live at home

If you are local to Eugene, this is a valid option, although it does not give your student the same feeling of independence that comes from moving out.

Work for the University of Oregon

Employees of the University of Oregon are eligible for a 50% tuition discount for their children. There are other rules that apply but this is a strategy many parents I know plan to use.

Finally, Here’s How NOT to Pay for College:

Don’t rob your retirement funds. The IRS allows IRA and Roth IRA account holders to make penalty-free distributions from their accounts prior to age 59 ½ if the distributions are made directly to the educational institution. You still have to pay income tax on the full distribution (Traditional IRA) or just on the earnings (Roth IRA), but you won’t have to pay a 10% penalty.

This is expensive money because you need these funds to stay invested in the market to ensure you have enough to live on when it’s time to retire. Especially if social security benefits aren’t paying out at 100%, you will need to rely on your retirement account savings to pay your bills when you eventually stop working.

Interested in personalized help when planning for college? I offer Education Planning as part of Ongoing Financial Planning services or I can build you a plan as a stand-alone one-time project. Learn more about my services here.

Full Disclosure: Nothing on this website should ever be considered to be advice, research or an invitation to buy or sell any securities. Please see the Disclaimer page for a full disclaimer.

Stacy Dervin, CFA, CFP® provides fee-only financial planning and investment management services in Eugene, Oregon. Tailored Financial Planning (TFP) serves clients as a fiduciary and never earns a commission of any kind. As a financial advisor, Stacy is on a mission to help Gen X and Gen Y be truly proactive about their financial futures.